Online advertising, what is the post-Coronavirus scenario?

For the first time since 2008, Google will close an annual budget in the red with regard to adv: even the giant of Mountain View is affected by the Coronavirus impact on advertising and the growth of various competitors, especially Amazon, which is gaining faster and faster a share in the adv search market: let’s see what is happening and what is expected to happen in the coming months.

Google’s advertising revenue is dropping

To give us some indiscretion is the traditional and authoritative update of eMarketer, which already at the end of last year had reported the new leading role that Amazon was having in the online ads market against Google.

For the first time since the research firm has carried out these estimates – that is, since 2008 – Google’s advertising revenues have been reduced on an annual basis in the rich US market: at the end of the year, the Mountain View group will see a decline in revenues of about 5.3 percent compared to last year, amounting to 39.58 billion dollars (against 41.80 at the end of 2019).

The drop of ads of Google Search

In the analysis, eMarketer indicates the reasons for this stop, which is directly linked to the consequences of the Coronavirus emergency and, in particular, to the collapse of investment in the travel sector (only in March, the paid expenditure in the travel sector has practically halved in the United States, falling by 90 percent) which has in Google the main channel of promotion for the sale of tickets and various packages.

The forecasts preceding the Coronavirus of eMarketer indicated for Google an advertising growth of almost 13 percent in 2020, recalls the head analyst of the company, Nicole Perrin, who highlights how “the travel sector – in the past heavily focused onGoogle search ad products – was among the most affected during the pandemic and reported the most extreme spending drops compared to any other sector”, and this penalized the performance of the Mountain View giant.

A historical drop for Google

The sharp decline has generated a first consequence on the sharing of the “cake” of online advertising in the United States, with Google losing over 2 percentage points of share in the paid ads market, falling to 29.4 percent compared to 31,6% reached in 2019.

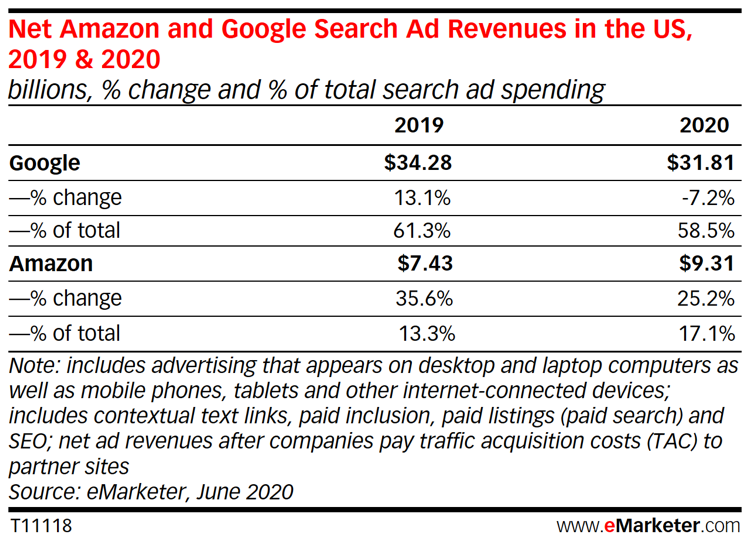

Even more evident is the crisis in the paid search adv segment, advertising revenue on search engines, which represents about 80 percent of Google’s advertising business: the net loss at the end of the year will be 7.2 percent to 31.81 billion (they were over 34 billion in the past year), while market share drops below 60 percent for the first time, reaching 58.5 percent of the entire cake (it was 61.3 percent just a few months ago).

The digital advertising market in the USA

To advance are especially the other giants of online advertising, and in particular Amazon and Facebook, because in reality the institute estimates an overall growth in the advertising investment sector, which should close in 2020 to 134.7 billion dollars, plus 1.7 percent compared to last year.

However, this is the lowest increase of the last decade, and another critical aspect (although not new) is that almost all of the market is in the hands of only three companies: the triopoly between Google, Facebook and Amazon collect more than 62 percent of digital advertising revenue in the United States.

Most of the investments continue to be earmarked for the Search segment, which captures 43.9% of total spending and touches on 54.7 billion dollars, an increase of about 13 percent compared to 2018.

Amazon and Facebook move forward

Google’s net loss went to the full advantage of its direct competitors. In particular, Facebook’s revenues on the advertising market will rise to 31.4 billion (plus 5 percent compared to 2019), with a market share that will reach 23.4 percent (it was 22.7), and the pace of the Bezos creature is even faster, who is setting himself up as a dangerous opponent for Big G.

The growth of Amazon and the chase to Google

Amazon’s advertising revenue is expected to increase by 23.5 percent overall, with a strong impact on the search market as well. Also in this case the Coronavirus effect is strongly felt, as the lockdown and the restrictions measures have pushed more and more people to buy online and “at a distance”, situation of which the marketplace has benefited.

Amazon’s search ad revenues alone are expected to increase this year by 25.2 percent, to close to 10 billion dollars (9.3, to be precise), with a market share in search advertising rising to 17 percent, thus eroding important chunks of investment to Google.

Unlike the search engine group, Amazon is not exposed to the travel sector and has even resisted to the (lower) decline in ads related to online shopping, while arriving – reportedly – to the “decision earlier this year to withdraw its ads from Google Search, as it struggled to meet customer demand for its e-commerce services,” Perrin says.

Google’s counterattacks to combat Amazon

In fact, Google has been struggling on this front for a long time, and it is in particular since 2016 that “its net advertising revenues in the United States grow at a slower pace than the overall digital ad market,” said the eMarketer analyst.

The evolution of the online advertising market is obviously pushing the Mountain View company to put in place several countermoves, starting with the launch of Google Shopping in a free version and the diversification of its advertising offering through various channels and tools, such as Discovery Ads campaigns or the boost to the Youtube collection.

The growth of ads on Youtube, however, will not “be enough to completely offset the more negative trends of Search”, because the search system “still represents the vast majority of Google’s net advertising revenues in the United States”, concludes Nicole Perrin.

The online adv market in Italy

If this is the US scenario – with Google facing the blunt of the crisis while instead Facebook and Amazon resist or even improve, and a market that overall bears the shake – in Italy the situation appears more critical.

According to GroupM, the total advertising investments of companies in our headquarter’s country will drop between 17 and 20 percent depending on the perimeter considered, a decrease worse than that suffered in the recent financial crisis-economic: as reported in an article by Engage, “cinema, experiential marketing, OOH and radio were the sectors most affected by the crisis, while TV and the Internet have held more”.

Much more pessimistic is the report of the Internet Media Observatory of the Politecnico di Milano, which estimates a double-digit decrease in internet advertising in Italy, which should close the year at -14 percent compared to 2019.

As still Engage reports, “the entire advertising sales in Italy will suffer a sharp contraction in 2020 and even the Internet channel will mark for the first time in its history a decrease”, albeit in a more limited way than other media. Specifically, the value could be around 2.8 billion euros, even going below the 2018 collection.

The analysis of digital adv channels in Italy

The study examines the expected performances of the individual channels of Italian digital adv, which have obviously suffered in a different way the blow of the pandemic.

- In Display advertising, the collection related to Video will fall by about 12 percent due to “both of the objective difficulties linked to the creation and production of contents during the lockdown months, and of the higher planning costs compared to other formats (which will in particular hinder the investments of SMEs)”. This has been the industry leader in the growth of the Internet market in recent years.

- The most traditional investments on Banners could fall even more than 15 percent, conditioned above all by the logic of Brand Safety: “in the period of maximum health emergency, in fact, many brands have avoided associating their creativity to the pages where there also were references to viruses, emergency and deaths, thus limiting the delivery of campaigns on different sites, especially informational ones”.

- Search advertising will fall by about 14 percent: this trend depends “especially on the sharp drop in online sales (and therefore research related to them) of services related to tourism, travel, ticketing and events, sectors that are experiencing a delicate situation, to say the least”.

- The Classified world “will suffer a very important decline, estimated over 20 percent”.

- Digital Audio advertising could be the only growing format, “although still marginal in absolute values and with a weight of less than 1 percent of the total market”.

Adv investments on the Internet are dropping, but less than other media

The crisis also affects the big international players, the so-called OTT, who “will see a 13 percent decrease overall, a decrease just below that of the overall market”, comments Andrea Lamperti, Director of the Internet Media Observatory, who however highlights that “their market share still remains very high, equal to 77 percent of the total”.

The decline in advertising on the Internet is however limited compared to the collapse suffered by other media in Italy: the global collection of adv at the end of 2020 will be close to 7 billion euros, the worst figure for at least 15 years, and all channels will fall well beyond the 20 percent threshold compared to 2019 (apart from TV, which will lose about 15 percent).

The marketshare of advertising investments still sees TV in the lead, with the share of 42 percent (equal to last year), but closely followed by the Internet that rises to 40 percent (it was to 38 in 2019): to follow at a distance there are other media, Press (9 percent), Radio (5 percent) and Out of Home (4 percent) that share the residual part of the companies’ expenditure.